Aussie Sinks Despite Hawkish RBA Comments

RBA Holds Rates

The Aussie Dollar has come under fresh selling pressure today despite the RBA holding rates steady overnight, citing fresh inflationary pressures. Following three prior cuts this year, the bank held rates steady at 3.6% yesterday noting that core inflation had moved higher along with a rise in consumer demand and house prices which warranted cause for concern. The move was expected on the back of the recent upside surprise in Q3 inflation data. On the back of yesterday’s meeting pricing for a December cut tanked further, now at around just 10%. Additionally, money markets are no longer pricing in a move as low as 3.35% from the current 3.6% level. Despite the hawkish skew to the meeting, AUD has dropped lower suggesting some resurgent concerns over weaker growth prospects given the threats shared by the RBA yesterday.

USD Strength

Continued strength in USD is also playing a part in the downside pressure we’re seeing in AUDUSD today. A hawkish surprise from the Fed at least week’s FOMC has seen USD rallying firmly over the last week. With traders no longer banking on a December cut, and uncertainty rising amidst the continued absence of key US data, the Dollar looks poised to continue higher near-term. Looking ahead this week, the ADP employment figure will be closely watched given the lack of public sector data and could fresh USD buying if we see any upside surprise. On the other hand, a downside surprise could help cap the USD rally for now, offering AUDUSD some support.

Technical Views

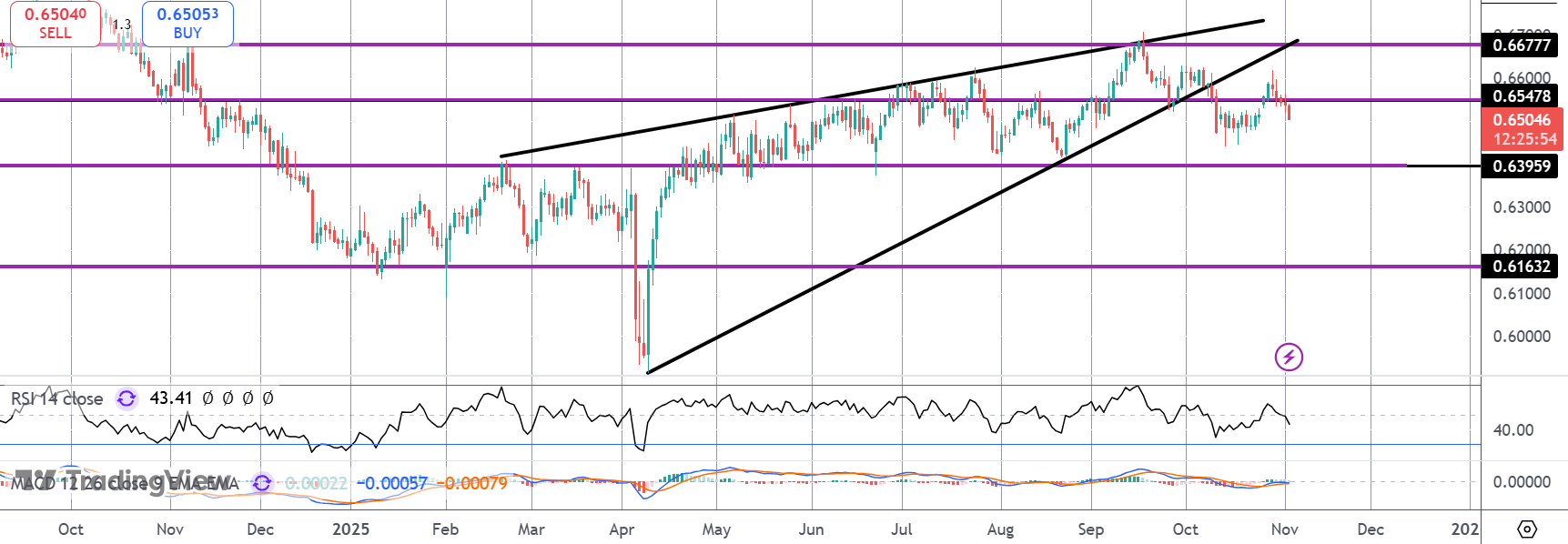

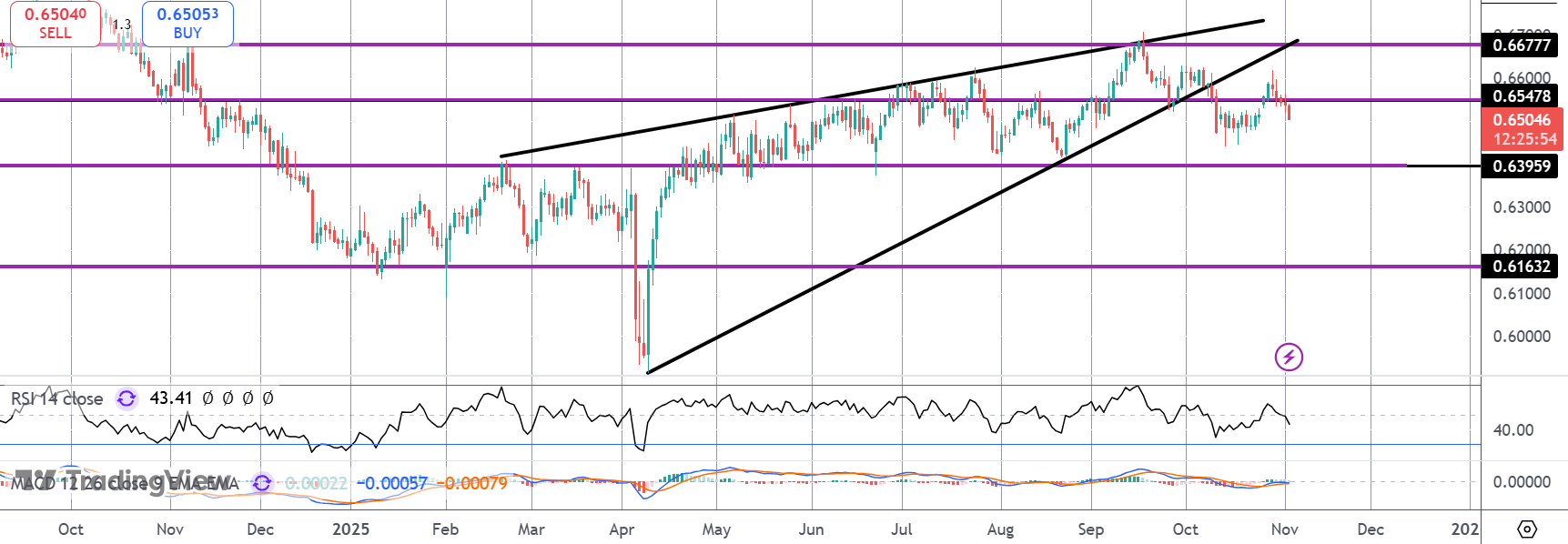

AUDUSD

AUDUSD is trading back below the .6547 level now with the risk of a fresh downside move growing on the back of the rising wedge break. The key level to watch now is .6395 with a break there seen opening the way for a much deeper move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.