REAL TIME NEWS

Loading...

Title EURGBP H4 | Falling towards key support Type Bullish bounce Preference The price is falling towards the pivot at 0.8670, an overlap support that is slightly below the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resi...

Title EURGBP H4 | Falling towards key support Type Bullish bounce Preference The price is falling towards the pivot at 0.8670, an overlap support that

Title USOUSD M30 | Bullish bounce off pullback support Type Bullish bouncePreference The price is falling towards the pivot at 64.64, a pullback support slightly below the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resis...

Title USOUSD M30 | Bullish bounce off pullback support Type Bullish bouncePreference The price is falling towards the pivot at 64.64, a pullback suppo

Title CHFJPY H4 | Bearish drop offType Bearish reversal Preference The price could make a short-term pullback towards the pivot at 199.30, a pullback resistance. A reversal at this level could lead the price toward the 1st support at 196.88, a pullback support. Alt...

Title CHFJPY H4 | Bearish drop offType Bearish reversal Preference The price could make a short-term pullback towards the pivot at 199.30, a pullback

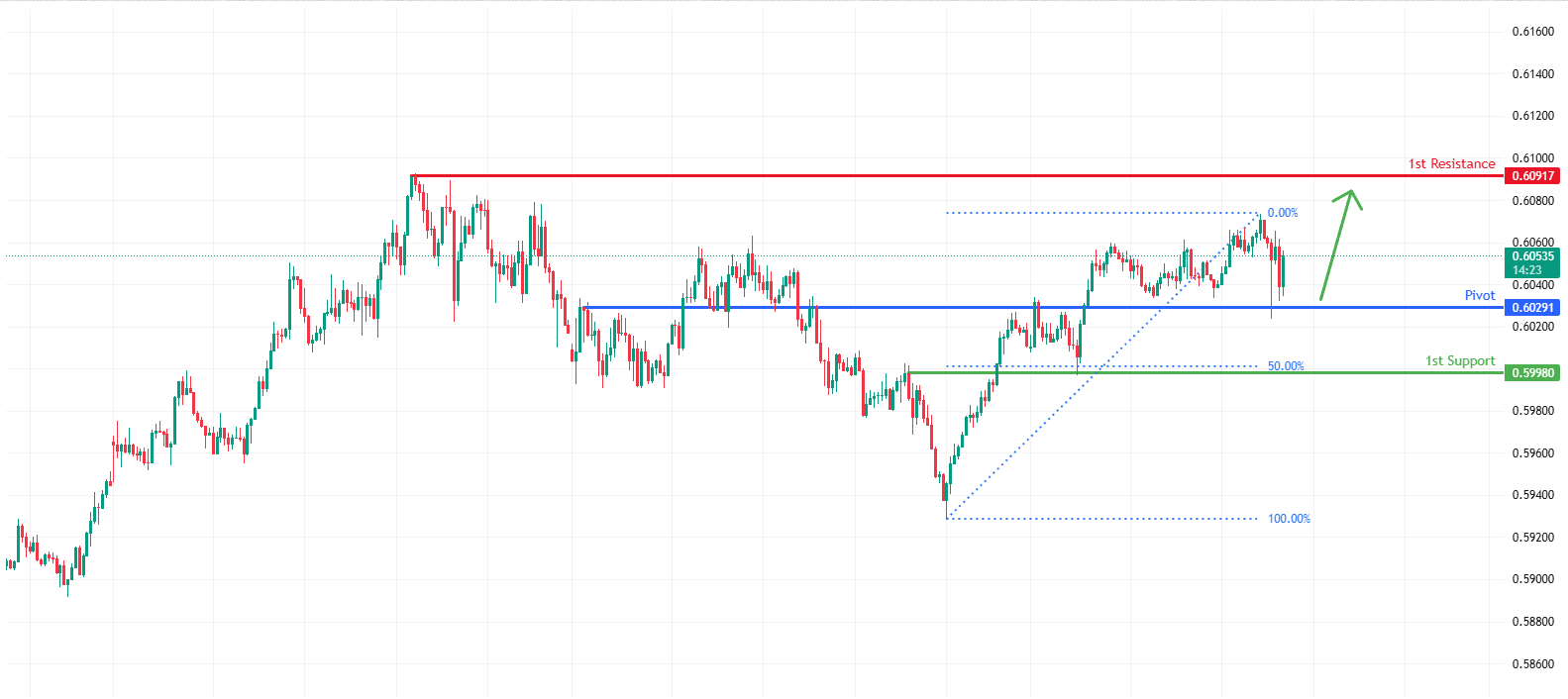

Title NZDUSD H1 | Potential bullish bounce off Type Bullish bounce Preference The price is falling towards the pivot at 0.6029, which is an overlap support. A bounce from this level could lead the price toward the 1st resistance at 0.6091, a swing high resistance....

Title NZDUSD H1 | Potential bullish bounce off Type Bullish bounce Preference The price is falling towards the pivot at 0.6029, which is an overlap s

SP500 LDN TRADING UPDATE 12/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6900/6890WEEKLY RANGE RES 7059 SUP 6847FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ...

SP500 LDN TRADING UPDATE 12/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

SP500 LDN TRADING UPDATE 11/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6900/6890WEEKLY RANGE RES 7059 SUP 6847FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ...

SP500 LDN TRADING UPDATE 11/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

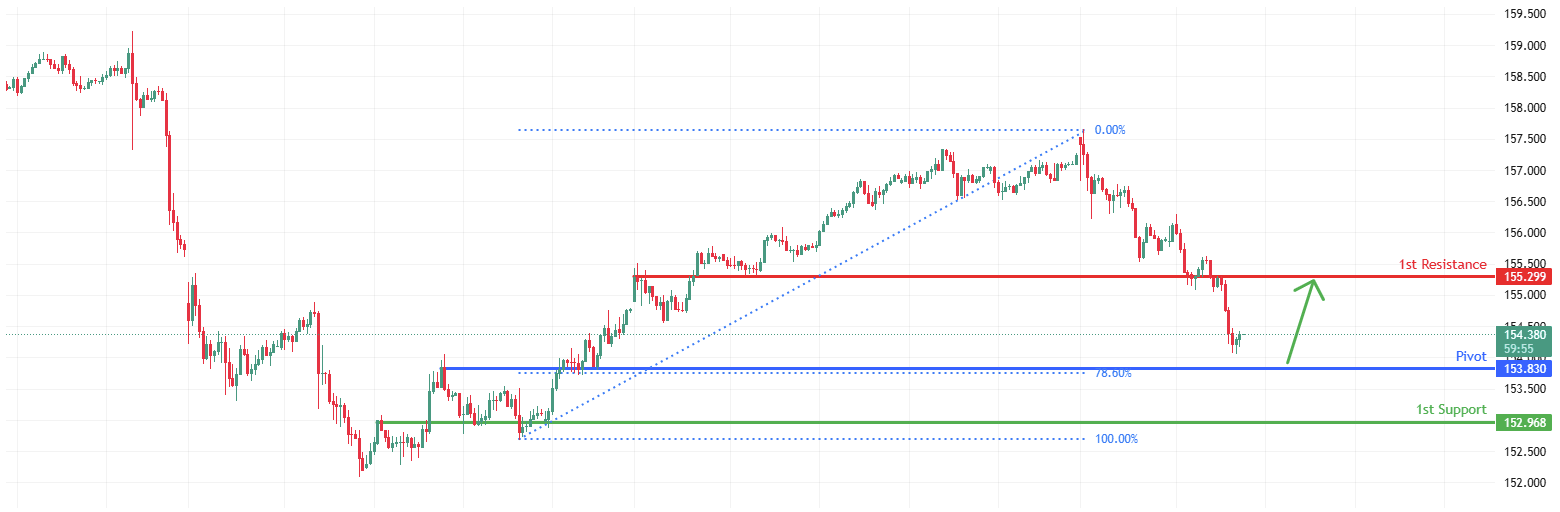

Title USDJPY H1 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling towards the pivot at 153.83, an overlap support that aligns with the 78.6% Fibonacci retracement. A bounce from this level could lead the price toward the 1st...

Title USDJPY H1 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling towards the pivot at 153.83, an overlap sup

Title XAUUSD H1 | Bullish bounce off 50% Fib support Type Bullish bouncePreference The price is falling towards the pivot at 4,906.10, an overlap support slightly above the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resi...

Title XAUUSD H1 | Bullish bounce off 50% Fib support Type Bullish bouncePreference The price is falling towards the pivot at 4,906.10, an overlap supp

Daily Market Outlook, February 11, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets continued their advance, printing records, while the Dollar took a hit ahead of Wednesday's much-anticipated US jobs report....

Daily Market Outlook, February 11, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets continued thei

USD: Funding Rotation Reversal – More Comfortable With USD ShortsYesterday’s session could be rated as highly engaging in terms of client inquiries (5/5) but relatively lackluster in client flow activity (2/5). This imbalance highlights some frustration, as the mar...

USD: Funding Rotation Reversal – More Comfortable With USD ShortsYesterday’s session could be rated as highly engaging in terms of client inquiries (5