Bitcoin Retests Major $100k Level

BTC Holding Key Support…For Now

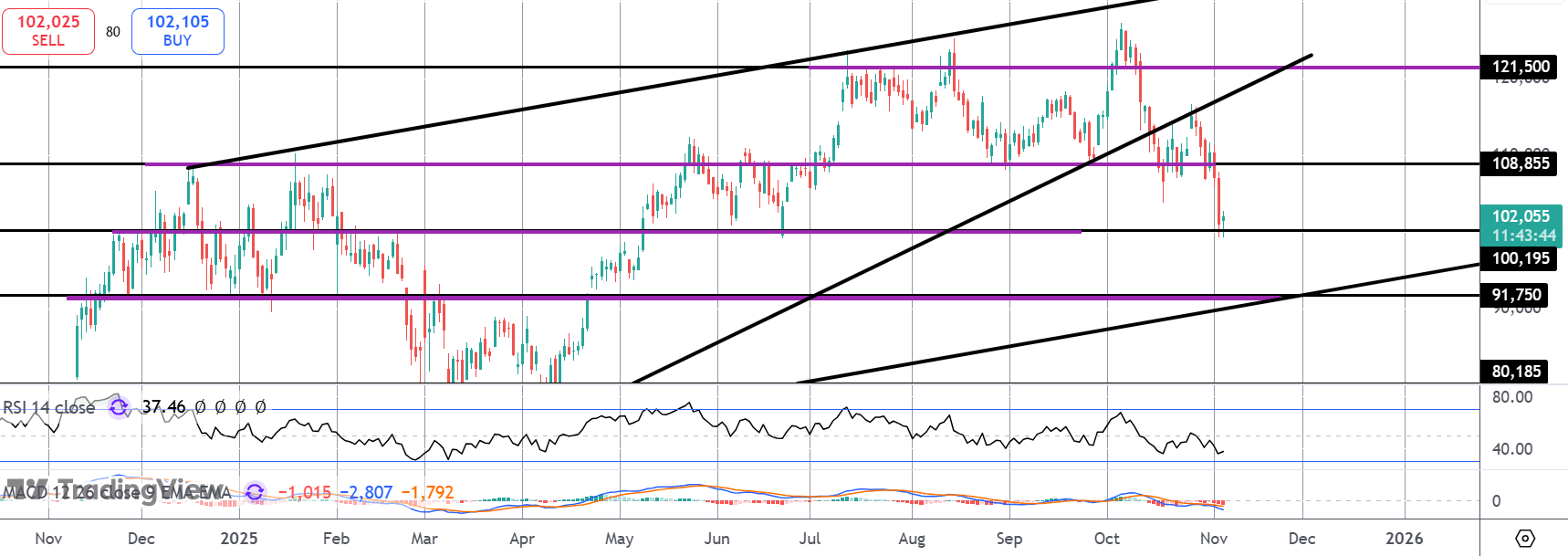

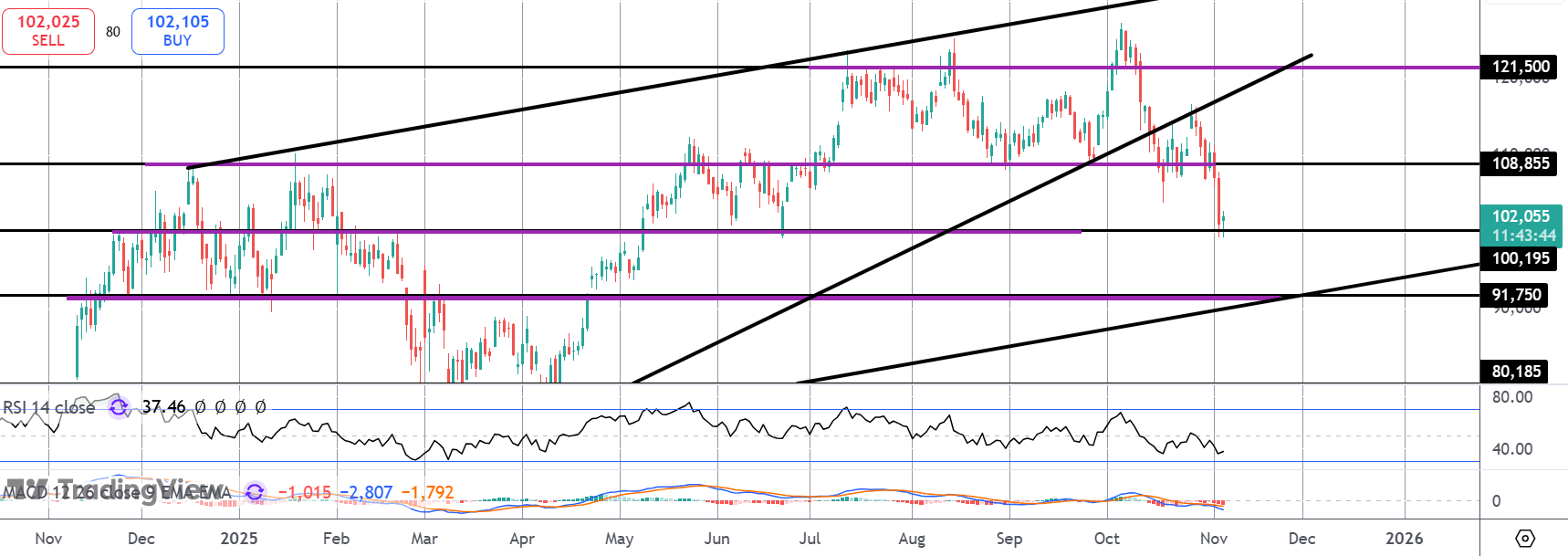

Bitcoin prices on watch today into key US data as the futures market attempts to stabilise following a fresh plunge lower yesterday. BTC traded down to test the June lows around the $100k level, falling as low as $99,250 before bouncing. The $100k level is a major psychological level for the market and bulls risk a much deeper and longer-run correction if this level goes. While it holds as support, however, an eventual rebound higher remains the focus.

US Data on Watch

Today, the US ADP print will be the main driver for markets. Given the sizable reaction we’ve seen in risk assets on the back of the Fed re-evaluation following the FOMC, there is plenty of volatility risk today. Rate cut expectations for December have dropped sharply, reflected in the plunge we’ve seen in BTC. If today’s data shows a fresh rise in jobs, particularly if above forecasts, this should see easing expectations dropping further, leading USD higher and BTC lower accordingly.

Huge ETF Outflows

Institutional outflows have been a key factor in the sell off this week. On Tuesday, ETFs recorded net outflows of $579 million, the largest one-day exodus of capital since August 1st. Over the last 5 days, just under $2 billion worth of longs have exited the BTC ETF space with BTC down around 10% this week as a result. While this dynamic continues, BTC looks vulnerable to further weakness near-term though yesterday’s outflows could also mark a capitulation point for now, setting up a recovery move.

Technical Views

BTC

For now, BTC is sitting on support at the $100k mark, within the lower part of the bull channel. Bulls need to get back above $108,855 to alleviate bearish risks and put focus back on a return to YTD highs. If we slip below $100k, however, the bull channel lows and $91,750 mark will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.