BTC Downside Risks Building - Key Week Ahead

BTC Weak on Monday

Bitcoin is on watch this week as the futures market continues to battle to stay above the $108,855 level. The marker has proved magnetic in recent months with several tests of the level. While continuing to hold as support for now, the focus remains on an eventual upside resolution in line with the broader bull trend. However, it feels like downside pressure is building here and if we do see a sustained break of the level, the market could quickly accelerate lower as longs cut positions and momentum sellers step in.

Institutional Flows

Institutional outflows have been a major headwind for BTC prices. Following the gap higher last week, prices quickly reversed lower with selling amplified on the back of the hawkish FOMC surprise last week. Alongside this decline, BTC ETFs saw heavy selling with around $1.2 billion in net outflows last week, putting an end to the recent period of accumulation we’d seen prior to the FOMC and US/China trade deal announcement. With institutional investors now seen accounting for around 26% of BTC ETF assets, institutional flows are having a growing impact on BTC price action and becoming a key market driver to monitor.

US Data

Looking ahead this week, traders will be watching USD moves closely. With the greenback rallying on the back of Powell’s warning last week that a December rate cut is not a done deal, downside risks are seen. If we do see a fresh USD rally this week, this could prove the catalyst for a deeper correction in BTC. The hope for bulls is that the US ADP print will heavily undershoot this week, capping the USD advance for now.

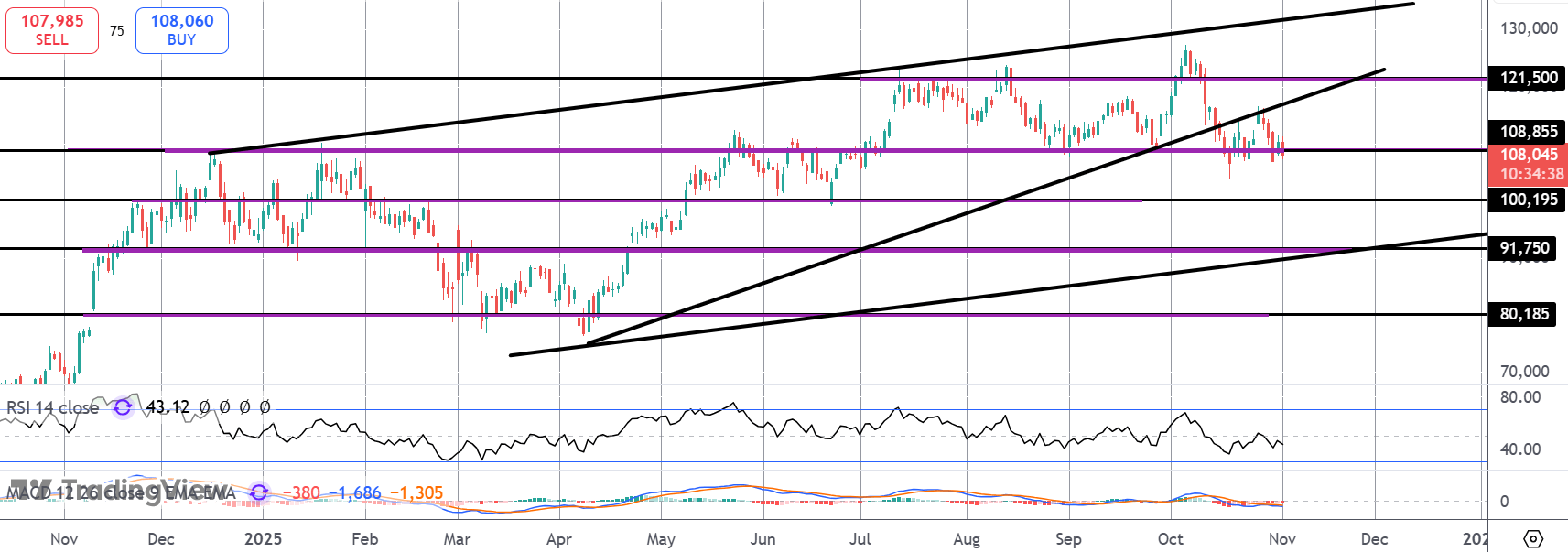

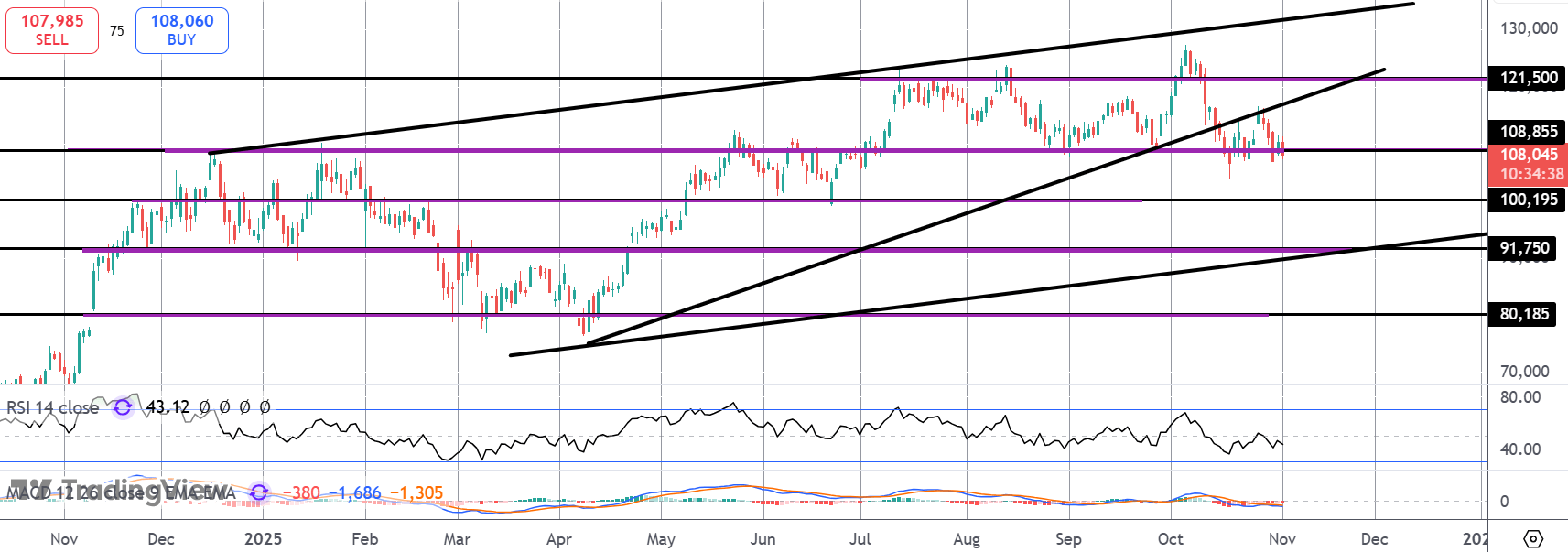

Technical Views

BTC

The failed retest of the broken bull trend line has turned the market back down onto support at the $108,855 level. With momentum studies bearish, downside risks are seen. If price breaks lower here, the $100k mark will be the next support to note. Topside, bulls need to clear $121,500 to alleviate downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.