Bullish Dollar Reversal Keeps Building

DXY Rally Continues

The reversal higher in USD is starting to gather pace now with DXY trading at its highest level since August today. The move comes amidst a shift in Fed outlook following hawkish warnings from Fed chair Powell last week, alongside an improvement in US/China trade relations and the announcement of a further tariff suspension. Pricing for a further cut in December has fallen below 70% now from around 95% ahead of the FOMC after Powell warned that further cut was not a foregone conclusion. The Fed President cited the absence of data (as a result of the US govt shutdown) as the driver behind the division over further easing. With the shutdown showing no signs of being resolved, this data drought looks set to continue which should keep December rate cut chances muted, in line with Powell’s comments.

Fed QT Impact

A shift in money markets is also helping drive USD higher here. The Fed has been steadily scaling back bank reserves this yeah while replenishing cash stocks. This quantitative tightening is seeing tighter lending conditions across the board. Indeed, the latest data shows that banks have been paying the upper end of the Fed’s rate range on its Standing Repo Facility funding. This dynamic typically feeds into a firmer USD which corroborates what we’re seeing currently.

US Data & Fed Speakers

Looking ahead this week, focus will be on the few private sector releases we have with ISM manufacturing number due today and Thursday’s ADP print. With the NFP remaining postponed, ADP should be a big market mover with any upside surprise likely to accelerate USD buying here. Alongside these readings we also have a mix of Fed speakers to monitor.

Technical Views

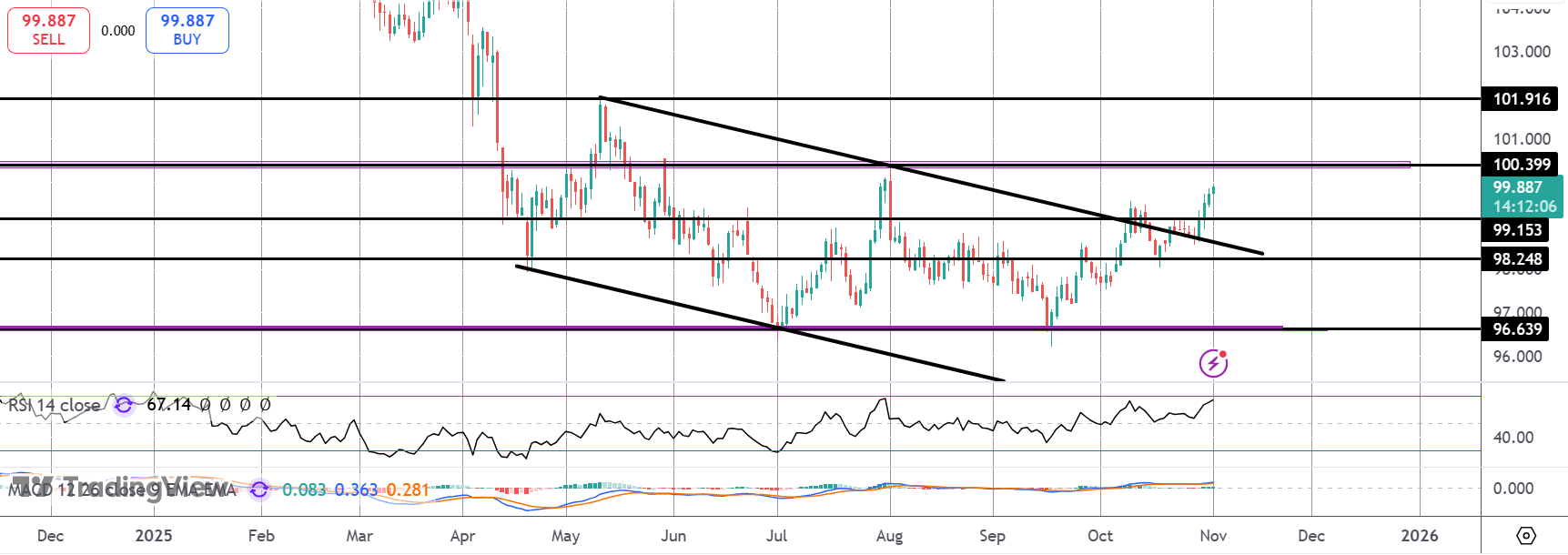

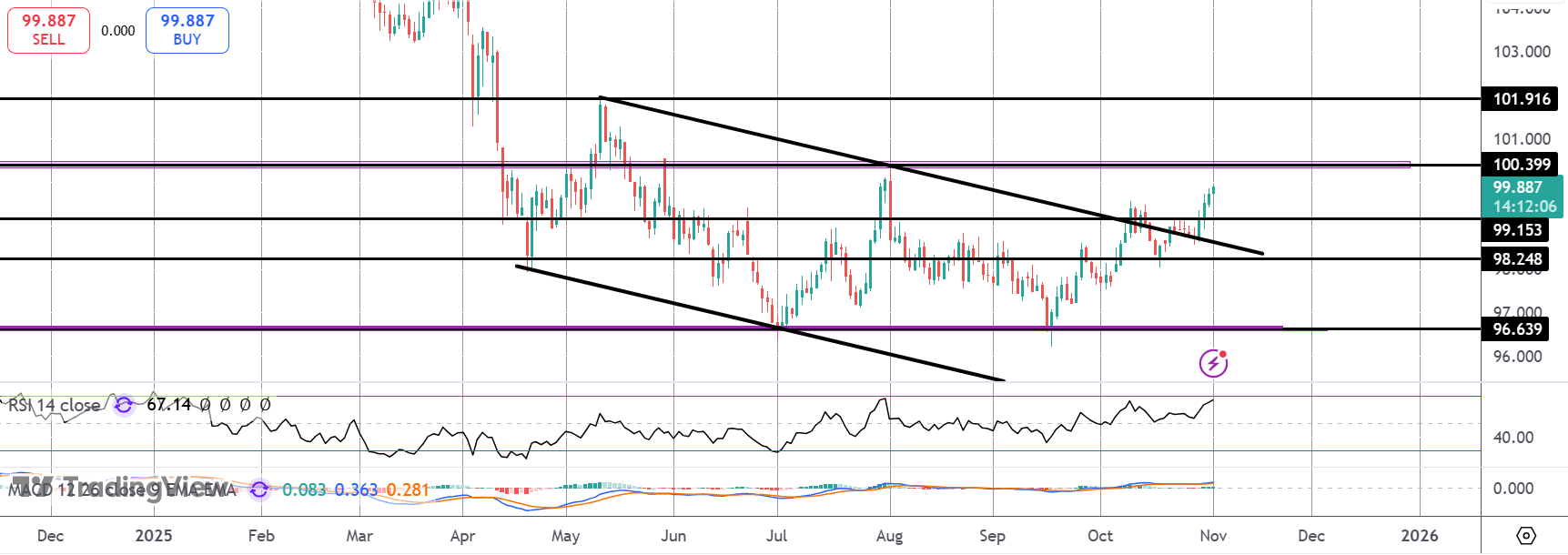

DXY

The breakout above the bear channel is gathering pace now with price pushing above the 99.15 level and the mid-October highs. With momentum studies bullish, focus is on a test of the 100.38 level next which capped the rally in summer. A break here will be firmly bullish putting 101.91 in sight next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.