REAL TIME NEWS

Loading...

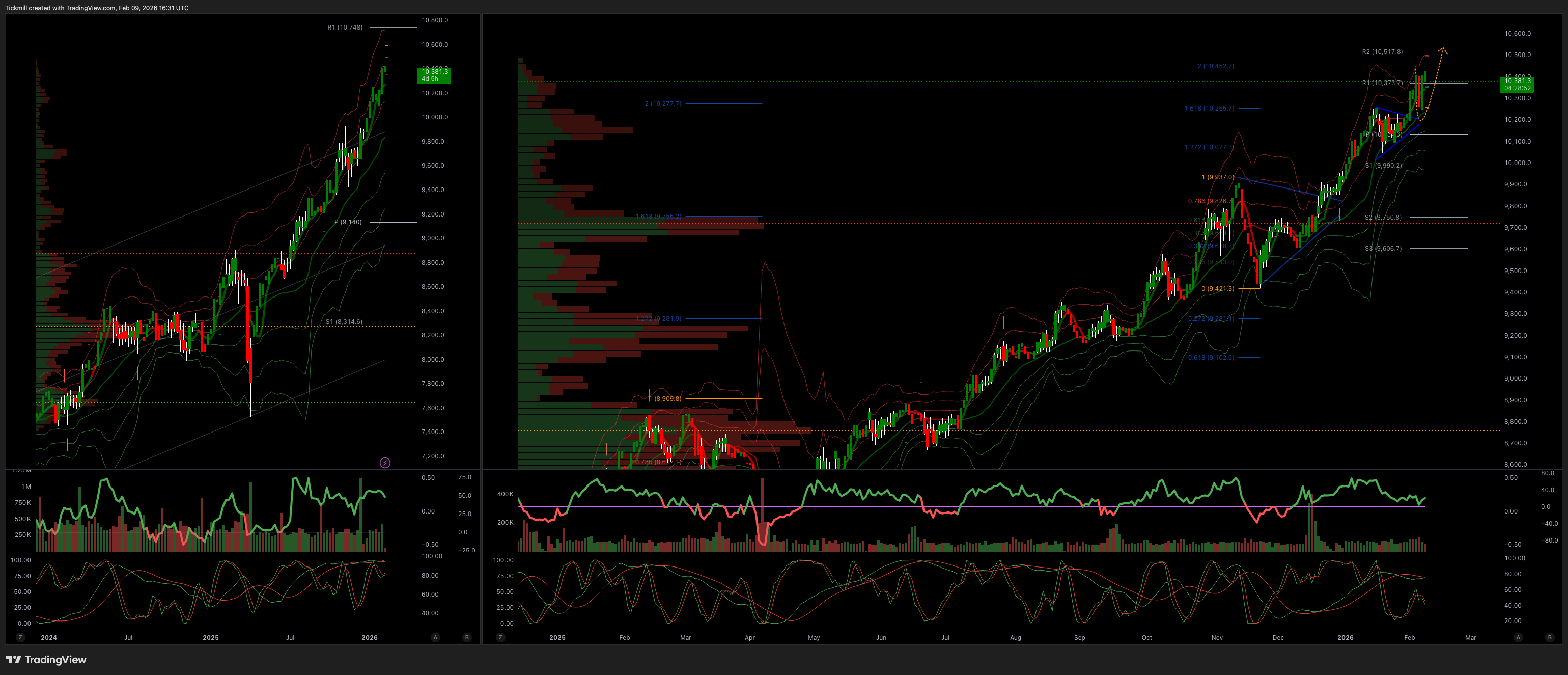

Market Overview: The index appears calm, but individual stocks show significant volatility. Historically, such extremes often precede negative S&P 500 returns 2-3 months later, even if the short-term outlook seems stable. ---1) Rates: Labor Market Concerns - Ma...

Market Overview: The index appears calm, but individual stocks show significant volatility. Historically, such extremes often precede negative S&P

Title EURGBP H4 | Falling towards key support Type Bullish bounce Preference The price is falling towards the pivot at 0.8670, an overlap support that is slightly below the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resi...

Title EURGBP H4 | Falling towards key support Type Bullish bounce Preference The price is falling towards the pivot at 0.8670, an overlap support that

Title USOUSD M30 | Bullish bounce off pullback support Type Bullish bouncePreference The price is falling towards the pivot at 64.64, a pullback support slightly below the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resis...

Title USOUSD M30 | Bullish bounce off pullback support Type Bullish bouncePreference The price is falling towards the pivot at 64.64, a pullback suppo

VWAP Swing Strategy Trading Update 12/2/26In this update, we review the latest alerts and trades for the VWAP swing strategy. To review today's video, click here!...

VWAP Swing Strategy Trading Update 12/2/26In this update, we review the latest alerts and trades for the VWAP swing strategy. To review today's v

Title CHFJPY H4 | Bearish drop offType Bearish reversal Preference The price could make a short-term pullback towards the pivot at 199.30, a pullback resistance. A reversal at this level could lead the price toward the 1st support at 196.88, a pullback support. Alt...

Title CHFJPY H4 | Bearish drop offType Bearish reversal Preference The price could make a short-term pullback towards the pivot at 199.30, a pullback

Title NZDUSD H1 | Potential bullish bounce off Type Bullish bounce Preference The price is falling towards the pivot at 0.6029, which is an overlap support. A bounce from this level could lead the price toward the 1st resistance at 0.6091, a swing high resistance....

Title NZDUSD H1 | Potential bullish bounce off Type Bullish bounce Preference The price is falling towards the pivot at 0.6029, which is an overlap s

Daily Market Outlook, February 12, 2026Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets continued their winning streak, climbing for the fifth consecutive day, as attractive valuations and promising growth prospects dr...

Daily Market Outlook, February 12, 2026Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets continued their

SP500 LDN TRADING UPDATE 12/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6900/6890WEEKLY RANGE RES 7059 SUP 6847FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ...

SP500 LDN TRADING UPDATE 12/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

SP500 LDN TRADING UPDATE 11/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6900/6890WEEKLY RANGE RES 7059 SUP 6847FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ...

SP500 LDN TRADING UPDATE 11/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

Title USDJPY H1 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling towards the pivot at 153.83, an overlap support that aligns with the 78.6% Fibonacci retracement. A bounce from this level could lead the price toward the 1st...

Title USDJPY H1 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling towards the pivot at 153.83, an overlap sup