Crude Lower As OPEC Signal Oversupply Concerns

Strong Dollar Hurting Crude

Crude prices are seeing heavy selling today as a combination of a stronger US Dollar and oversupply concerns weigh on sentiment. The futures market is down almost 2% today as the reversal from around the $61 highs continued on Tuesday. On the Dollar front, a hawkish surprise from the Fed last week has driven a sharp repricing of the rates outlook, fuelling an uptick in USD which is having a sizable cross-market impact this week. With Fed president Powell cited heightened uncertainty and division mong policymakers due to the lack of data, a furtehr cut looks less likely each week the US govt shutdown continues. Against this backdrop, USD is likely to stay bid near-term, keeping oil prices capped.

OPEC+ To Pause Output Hikes

Oil prices are also being dampened this week by the latest OPEC+ news. Following several consecutive months of output increases, the group announced this week that it would pause output hikes over the early part of next year with the potential for them to be extended furtehr as the group monitors a significant build in inventories across OECD countries. The concern over supply levels has clearly spooked investors with crude being sold accordingly. As such, traders will be monitoring incoming inventory news with any fresh upside likely to put furtehr pressure on crude near-term.

Technical Views

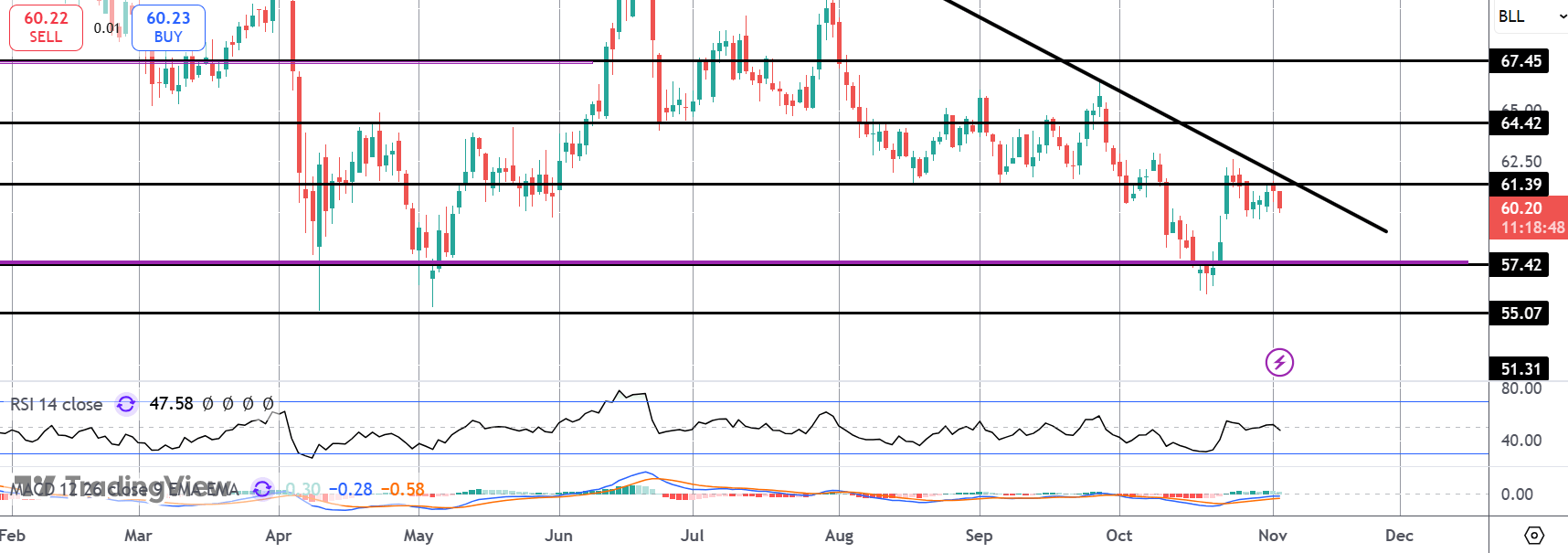

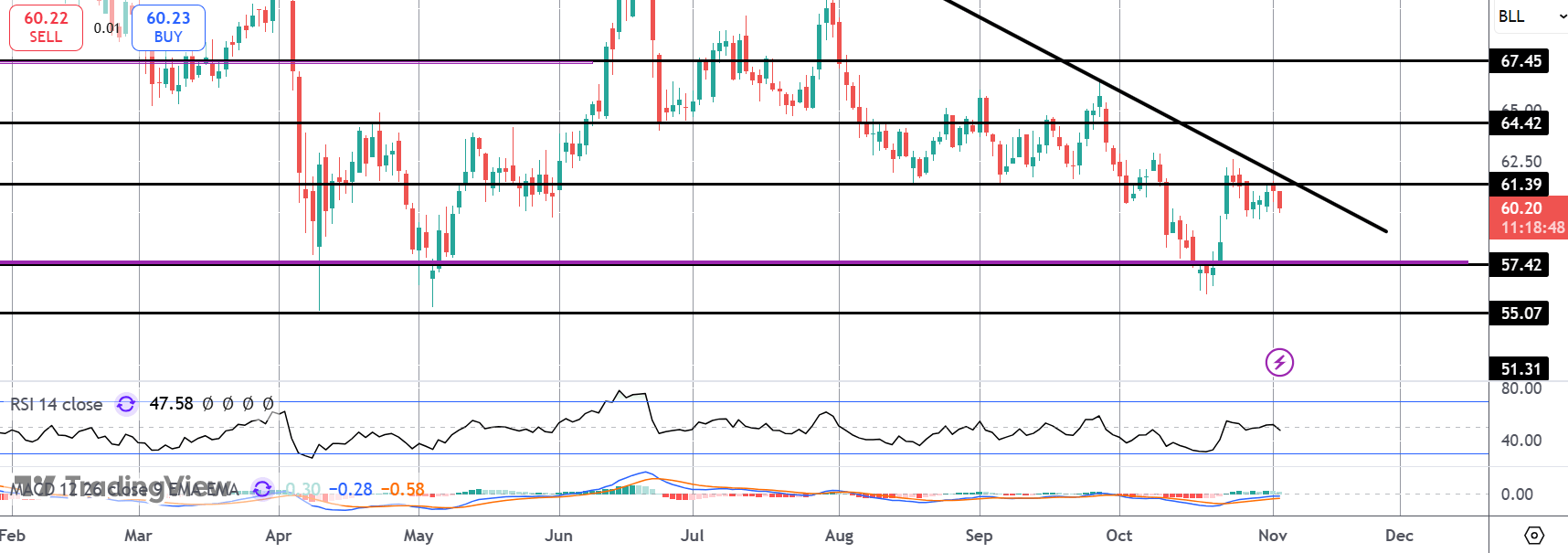

Crude

The failure at the latest test of the 61.39 level and bear trend line suggests that fresh test of the 57.52 lows could be in store. Momentum studies are weakening here and while we remain below this resistance the YTD lows will act as a magnet around 55. Topside, bulls need to see a break of the trend line and 61.39 level to mute these downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.