Gold Rally Accelerating

Gold Breaks Out

Gold prices are pushing higher again this week with the futures market recording new all-time on Monday morning. The prospect of a partial US government shutdown this week (which would delay the release of Friday’s US jobs data) is weighing on USD and driving fresh safe-haven demand for gold today. Unless the government can agree a last-minute funding deal by tomorrow, the shutdown will commence on Wednesday. Given the importance of Friday’s data in gauging the likelihood of a furtehr Fed rate cut in October, a delay in that reporting will fuel a great deal of uncertainty among traders which should benefit gold further near-term.

Bullish Gold Outlook

Given the uncertainty around a potential US government shutdown and accompanied by the broader dovish outlook on the Fed, gold prices look poised to continue to advance near-term. Demand for gold was a key theme over Q1 and with intensifying geopolitical concerns seen too (rising uncertainty over Russia) investors are likely to continue to prefer gold over other asset classes such as US debt. Additionally, trend and momentum buying in gold should draw in more speculative capital also, helping to drive the rally higher.

Technical Views

Gold

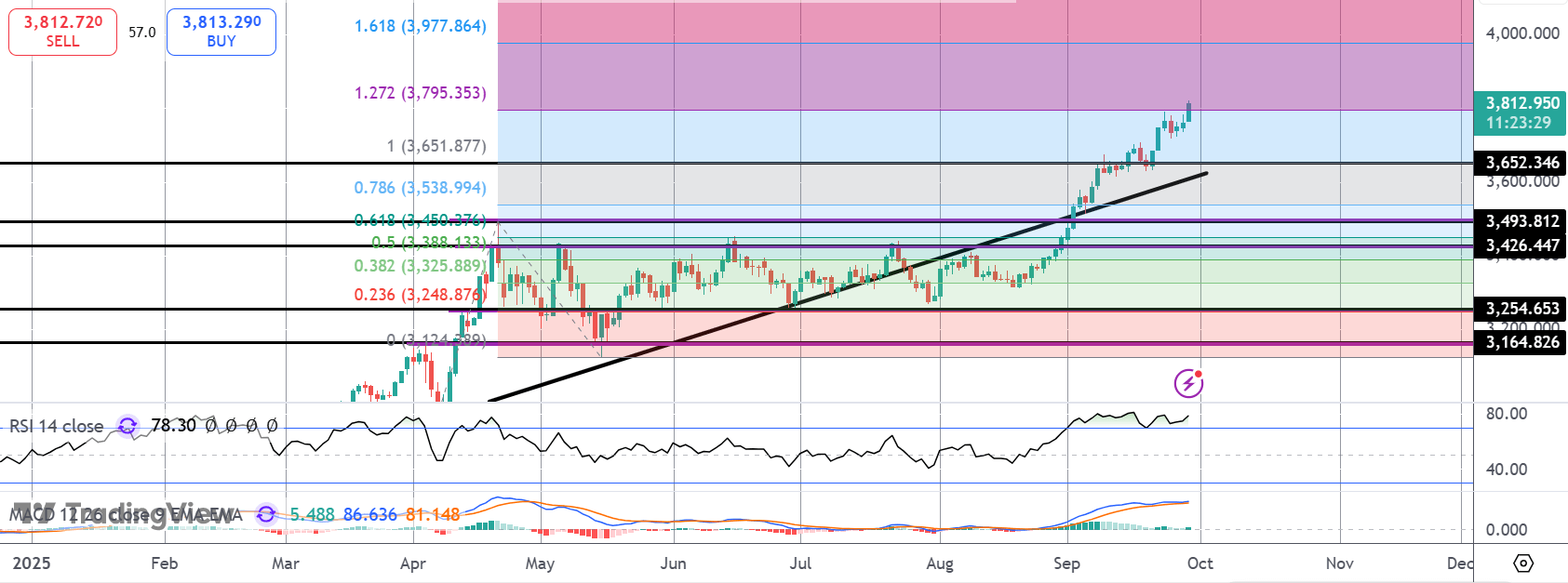

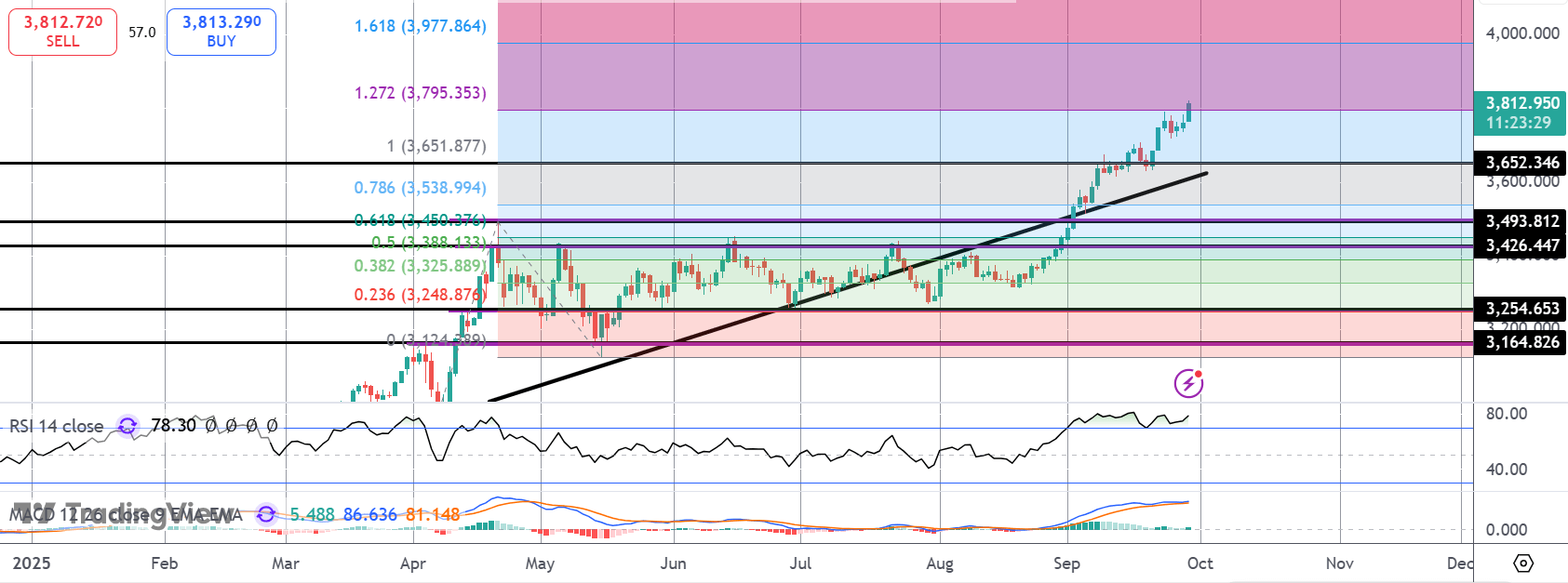

After stalling briefly at the 1.27% fib extension, the market is now pushing higher once again. The 1.61% extension, just ahead of the 4k level will now b ethe next objective for bulls. Worth noting that we are seeing bearish divergence in momentum studies, suggesting reversal risks. However, the broader bullish outlook remains in place while price holds above the 3,652.34 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.