Institutional Insights: Deutsche Bank Investor Flows & Positioning 22/9/25

In early July, we observed that despite equities reaching record highs and a narrative of heightened risk appetite, overall positioning was neutral, with only isolated pockets of exuberance. Fast forward to today: the S&P 500 has climbed further, equity positioning has increased, but remains only moderately overweight. Momentum chasing is evident, though confined to specific areas.

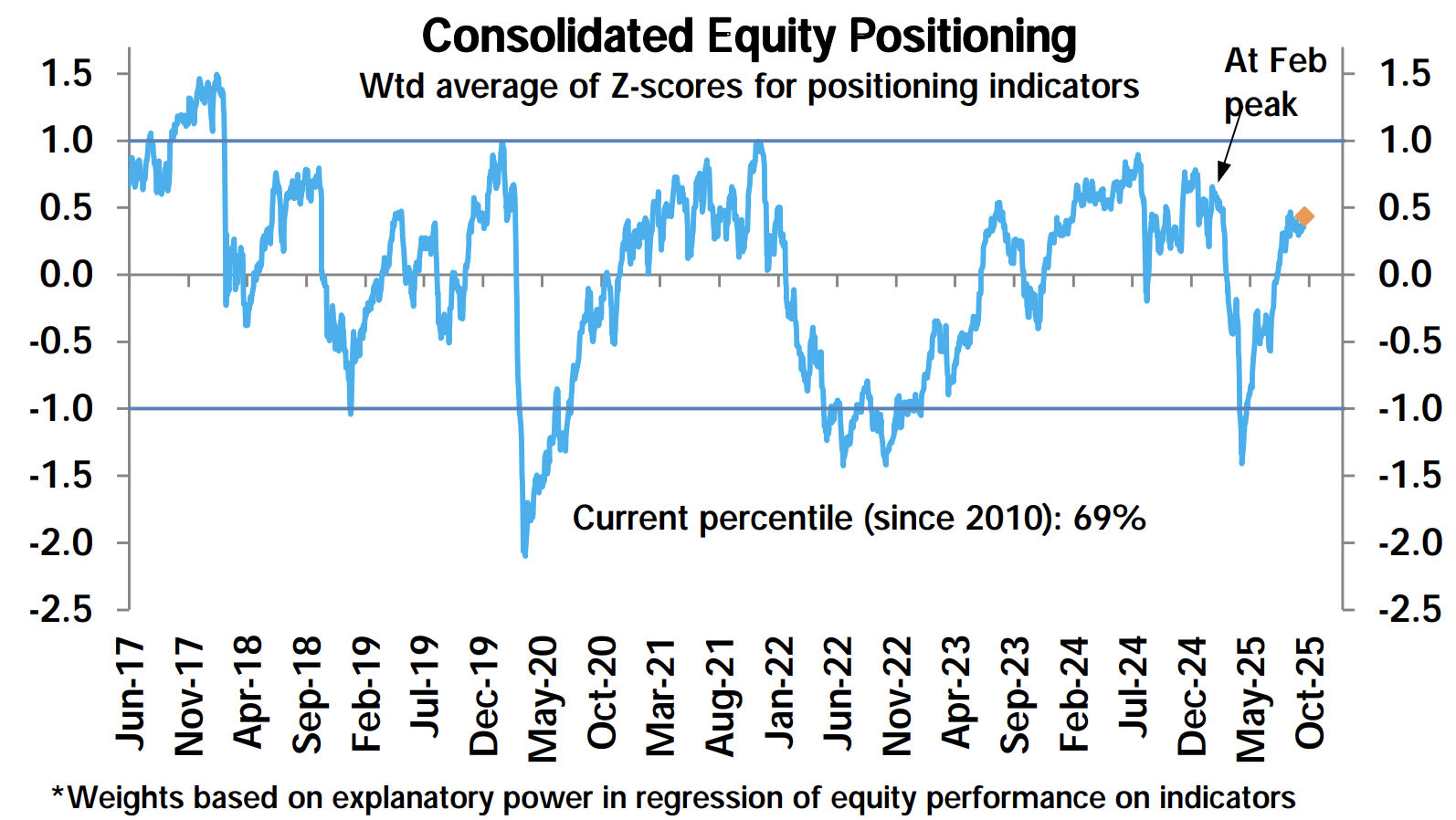

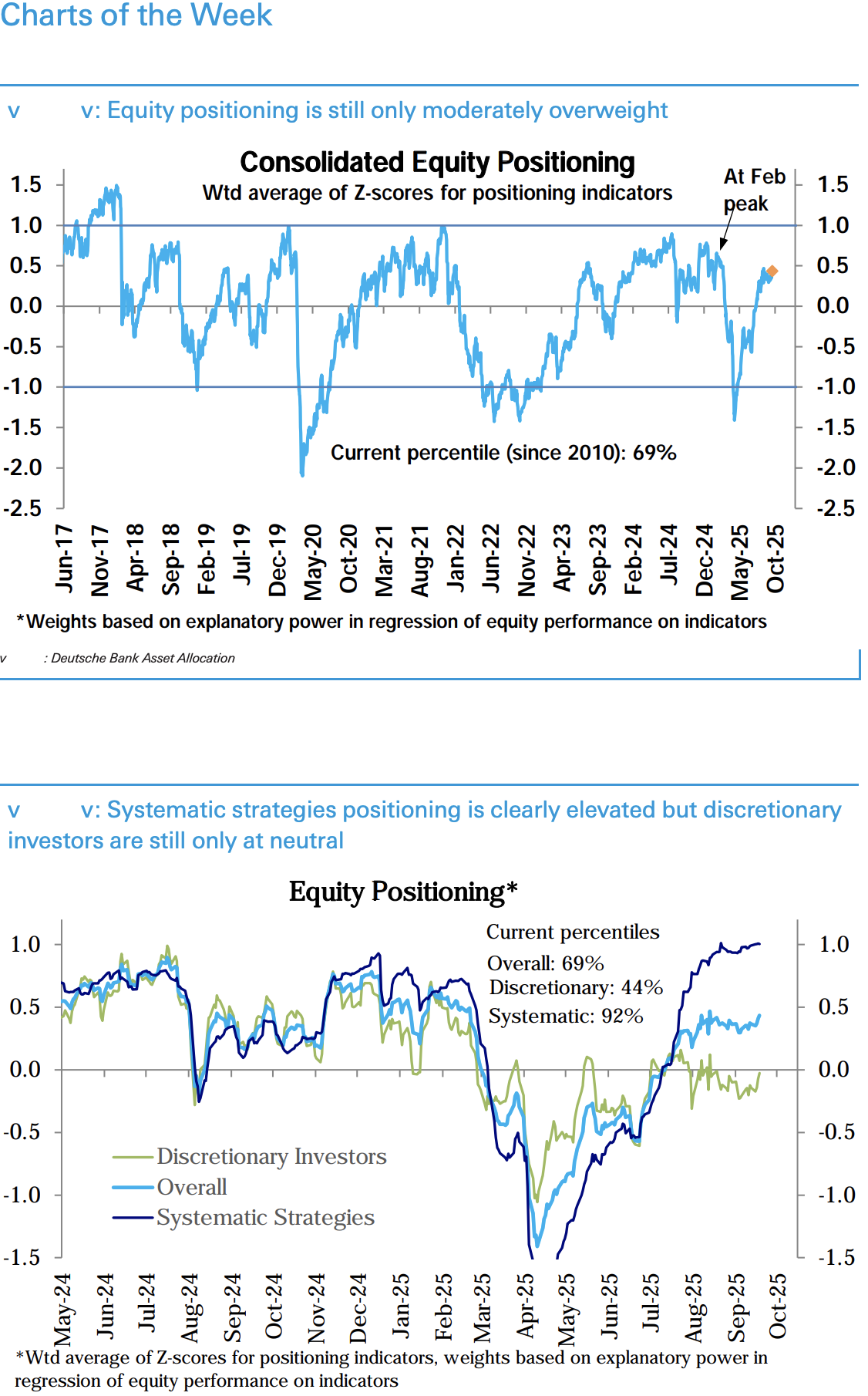

- Equity Positioning: Equity positioning has reached a one-month high, moderately overweight at 0.43 standard deviations (69th percentile). It is still far from extremes that might signal heightened reversal risks. Notably, discretionary investors raised exposure slightly this week (-0.03sd, 44th percentile), but remain neutral, leaving room to align with robust macro and earnings growth. Systematic strategy positioning, however, is clearly elevated at 1.00sd (92nd percentile).

- Momentum Chasing: Signs of momentum-driven activity are visible in certain areas. For instance, stocks with the highest net call volumes over the previous week rallied sharply after two months of underperformance. This suggests rising risk appetite and momentum-driven buying. Similarly, a short-term momentum basket of stocks surged, and inflows into momentum-targeting funds hit their highest levels this year. Investor sentiment has also rebounded sharply, moving to the middle of its range after hovering near extreme lows last week. However, broader indicators of risk appetite, such as inflows into leveraged and single-stock ETFs, remain subdued.

- Equity Inflows: Equity funds saw near-record inflows this week ($68bn), with $58bn directed toward the US. While this is impressive, it aligns with typical September seasonality, which often sees large inflows. Historically, this pattern suggests a potential lull in flows in the coming weeks, followed by a ramp-up in the last two months of the year that continues into the first quarter of the next year.

- Post-FOMC Rally: The post-FOMC rally aligns with recent trends, with nine of the last 12 FOMC meetings resulting in the S&P 500 closing higher the following day by a median of 0.5%. This reflects the buildup and subsequent dissipation of equity volatility premiums. While attention remains on the magnitude of future rate cuts, equities are primarily driven by rate volatility rather than rate levels. Rate volatility has continued its downward trend, reaching levels last seen in late 2021 and returning to its pre-tightening cycle range.

In summary, while equity positioning and momentum chasing are gradually increasing, broader risk appetite indicators remain cautious. The seasonal flow dynamics and rate volatility trends suggest a measured path forward for equities.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!