TRADING NFP – JANUARY 2026

JPM US MARKET INTELLIGENCE NOT A PRODUCT OF RESEARCH

US MARKET INTELLIGENCE NFP SCENARIO ANALYSIS

Feroli’s NFP preview projects 75k jobs added, surpassing the Street’s estimate of 59k. November recorded 64k jobs. For the unemployment rate (U.3), Feroli anticipates 4.6%, slightly above the Street’s estimate, with the prior reading at 4.564% (rounded to 4.6%). Average Hourly Earnings are expected to rise by +0.3% MoM and +3.6% YoY.

The following scenario analysis reflects a trading desk view from JPM US Market Intelligence and is NOT A PRODUCT OF JPM RESEARCH:

- [5% Probability] Above 105k: SPX declines 0.5% – 1%.

- [25% Probability] Between 75k – 100k: SPX gains 0.25% – 1%.

- [40% Probability] Between 35k – 75k: SPX gains 0.25% – 0.75%.

- [25% Probability] Between 0k – 35k: SPX ranges from a 0.25% loss to a 0.5% gain.

- [5% Probability] Below 0k: SPX declines 0.5% – 1.25%.

OPTIONS PRICING

For options expiring on January 9, the market is currently pricing a ~1.2% move as of market close on January 2.

US MARKET INTEL ON NFP

We anticipate an inline to slightly stronger print. Despite concerns of a soft patch in the economy during late summer/Q3, the expected slowdown did not occur. Q3 GDP grew by 4.3%, following a 3.8% increase in Q2. This consumer-driven expansion has been unusual, as hiring has lagged behind the surge in spending and growth.

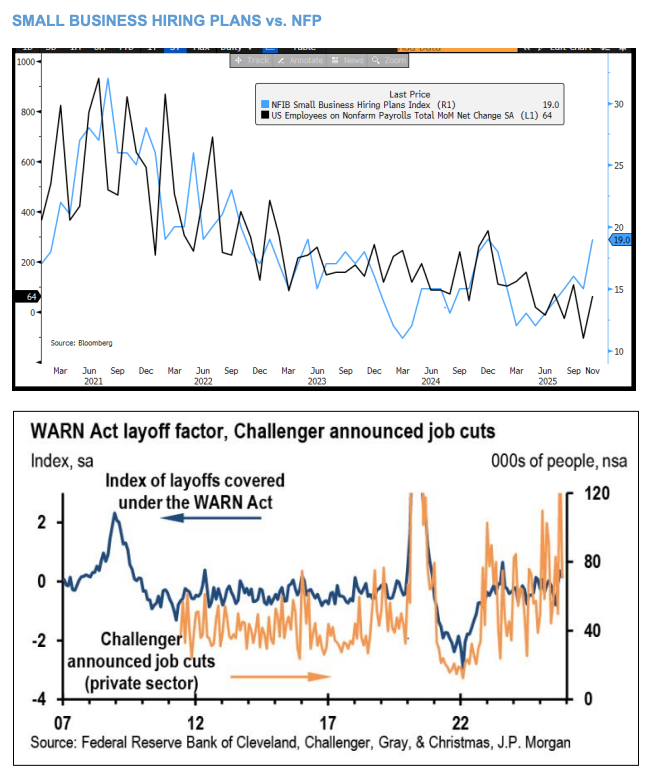

The key question now is whether hiring will pick up to support the robust consumer activity. The NFIB Small Business Survey’s Hiring Sub-index, which often leads NFP trends by 1–2 months, has been rising since the summer. While this might not fully reflect in this week’s print, the trend suggests a potential acceleration in hiring. It remains to be seen if this hiring resurgence will introduce any inflationary pressures.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!