Is Bitcoin At Risk of A Major Breakdown?

BTC Testing Key Support

Bitcoin bulls are in trouble today with danger signs flashing as the futures market tests the October low. BTC has come under heavy selling pressure again this week, extending losses on the back of last week’s reversal lower as traders reacted to a hawkish surprise from the Fed. Despite cutting rates by a further .25%, Powell warned that a follow-up cut in December was not a done deal, highlighting growing uncertainty and division among policymakers. On the back of those comments, pricing for a December cut has fallen from around 95% to around 65% with USD rallying accordingly. Risk assets have suffered as a result with crypto seeing a wave of liquidations across the board. Against this backdrop, BTC looks vulnerable to continued downside near-term as ETF outflows ramp up.

US ADP Data Tomorrow

Looking ahead, the only hope for BTC this week is a heavy downside surprise in the ADP print tomorrow. With the US govt shutdown rolling on and the subsequent lack of public sector data, private sector readings have become the key focus point. As such, if tomorrow’s ADP data heavily undershoots forecasts, this could revive Fed December easing prospects, capping the USD rally and causing a squeeze higher in crypto. However, if the data rise as expected or worse still beats forecasts, this should se BTC falling faster as traders further scaled back December easing expectations.

Technical Views

BTC

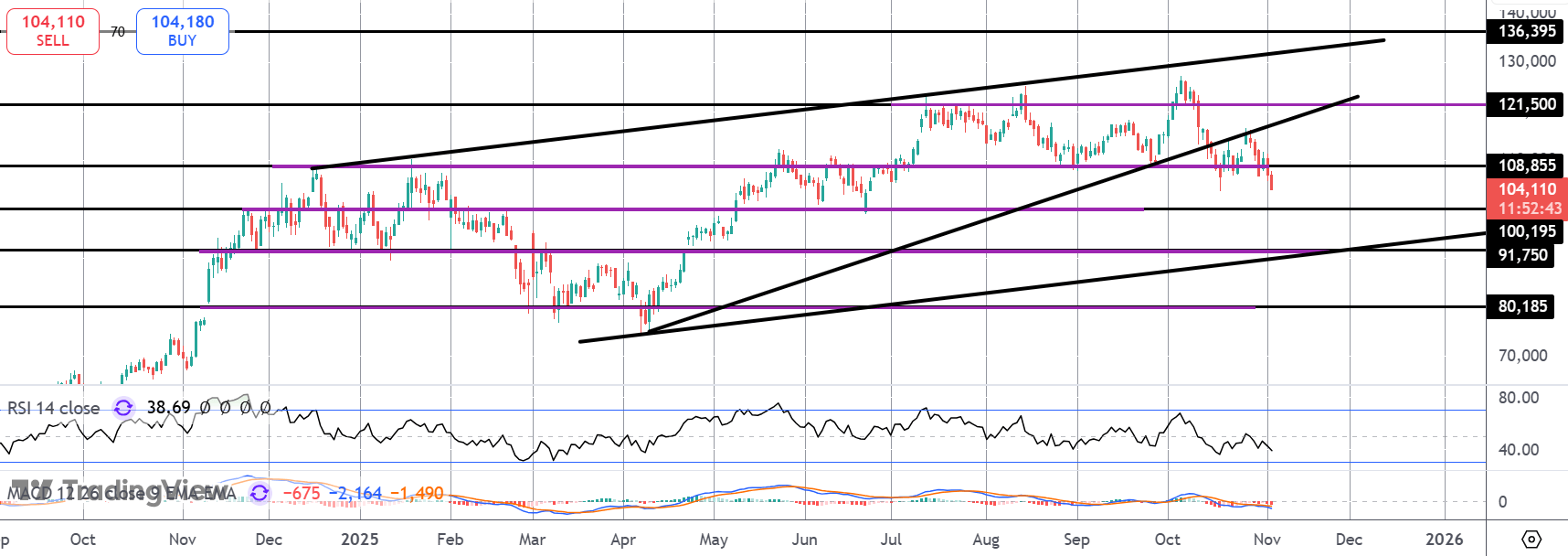

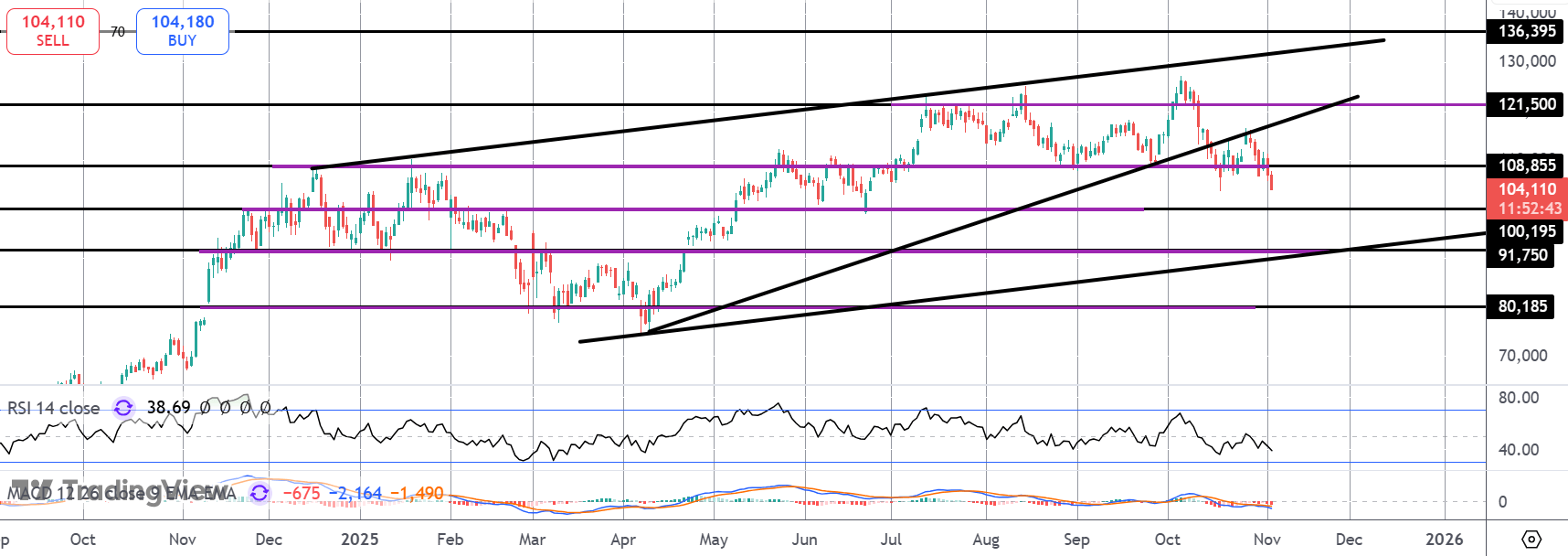

The sell off in BTC is gathering pace again now following the failed retest of the broken bull trend line. Price is now sub-$108,855 and testing the October lows. Below here, the $100k mark is the ley level to watch and will be pivotal for medium term direction for the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.