Silver Double Top Risks

USD Strength Hits Silver

Silver futures are fighting to stay above the $50 level today following a heavy reversal from last week’s highs. The move lower tracks the sell off in gold with metals prices coming under heavy selling pressure amidst a shift in traders’ Fed outlook. Pricing for a December cut has roughly halved in the last few weeks following a hawkish surprise from Powell at the October FOMC. Powell warned, despite cutting rates by a further .25%, that a follow-up cut in December was not a done deal, citing division among policymakers. The absence of data amidst the US govt shutdown was noted as the reason for the split among Fed members. Since then, easing expectations have fallen heavily with USD rallying accordingly, capping the bullish momentum in metals.

Fed & US Data

Looking ahead, traders will now be closely watching incoming Fed minutes tomorrow and labour market data on Thursday. Given the hawkish surprise from Powell at the FOMC, the minutes are not expected to be friendly for doves. Indeed, since that meeting we’ve heard hawkish comments (or at least a lack of dovishness) from several Fed members. As such, the minutes tomorrow are likely to further weigh on metals prices. However, Thursday’s delayed September NFP release will be the headline event for the week. If we see any upside surprise in the data, this should be firmly bearish for metals, sending December easing expectations heavily lower. However, if we get any surprise undershoot in the data, this should help revive easing expectations, fuelling a pullback in USD and allowing metals to bound back.

Technical Views

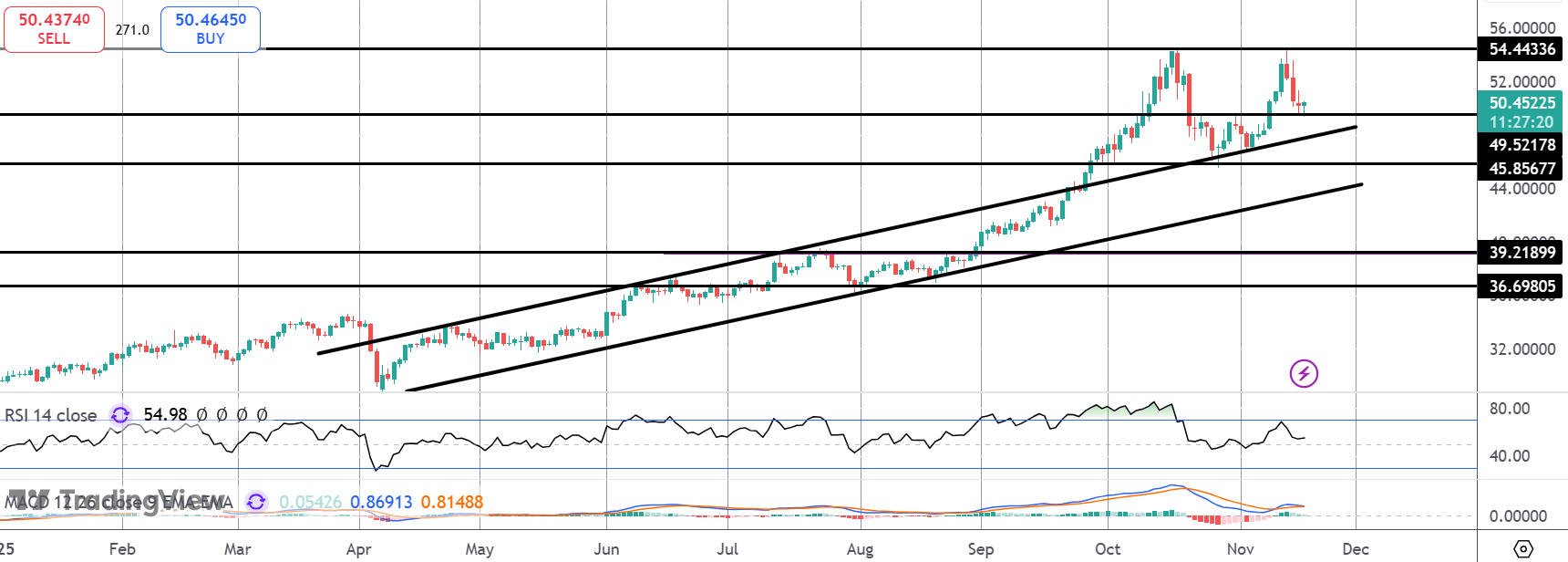

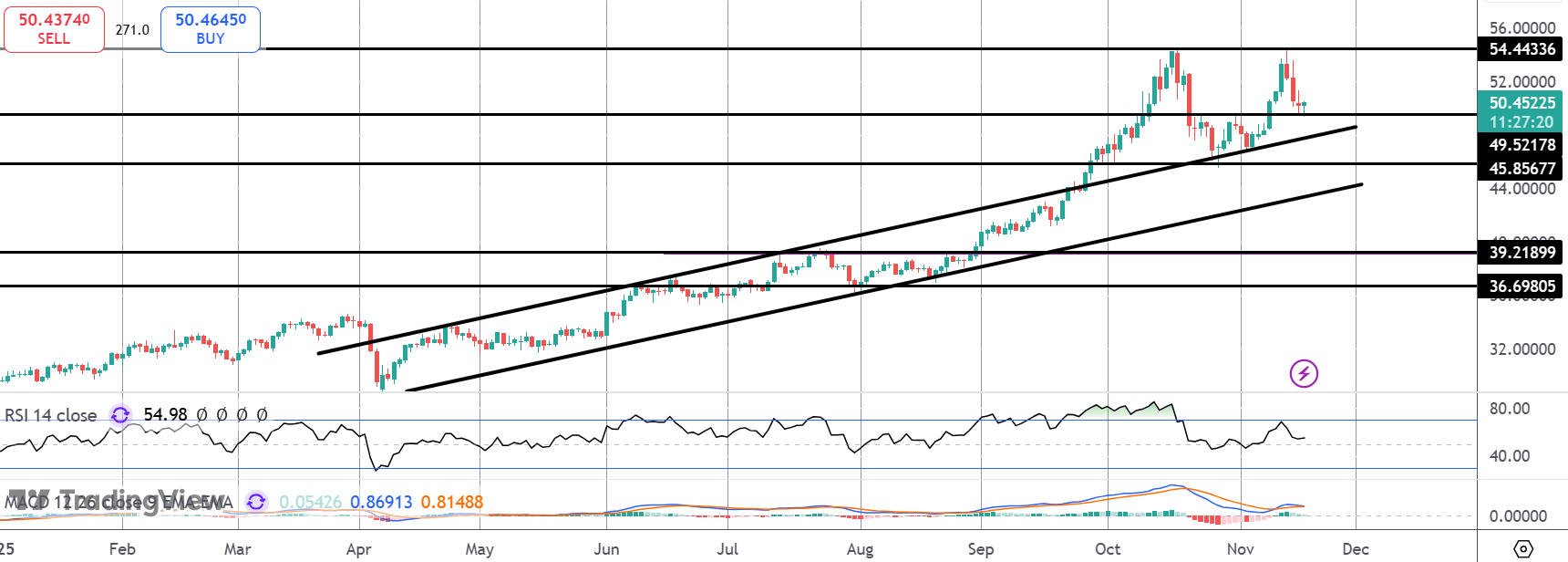

XAGUSD

The rally in silver has stalled for now into a fresh test of the 54.4433 level highs with risks of a double top now forming at hat level. This view is endorsed by heavy bearish divergence in momentum studies. Price is currently being supported by the 50 level, with the broken bull channel highs just below. If bears can break below this level focus turn to 45.8567 as the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.