SP500 LDN TRADING UPDATE 5/11/25

SP500 LDN TRADING UPDATE 5/11/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/10

WEEKLY RANGE RES 6981/6767

NOV EOM STRADDLE 6929/6399

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 6626/7054

DAILY STRUCTURE – ONE TIME FRAMING LOWER - 6849

DAILY BULL BEAR ZONE 6820/10

DAILY RANGE RES 6864 SUP 6747

2 SIGMA RES 6921 SUP 6691

DAILY VWAP BEARISH 6850

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

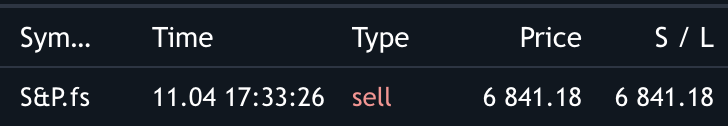

SHORT ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT OF 6777 TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: WOBBLE

S&P closed down 117bps at 6,771, with MOC showing +$400m to Buy. NDX dropped 207bps to 25,435, R2K fell 164bps to 2,430, and the Dow declined 53bps to 47,085. Total US equity trading volume reached 19.8 billion shares, surpassing the YTD daily average of 17.3 billion shares. The VIX rose 10% to 19, WTI Crude slipped 108bps to $60.39, the US 10YR yield gained 2bps to 4.08%, gold dropped 170bps to $3,946, DXY increased 35bps to 100.21, and Bitcoin plunged 6.3% to $100k.

Broad-based risk reduction was evident, with price action reflecting mounting risk/reward concerns that have been brewing recently. Rotational flows favored sectors like Financials, Biotech, Healthcare, Staples, and REITs, all closing higher. Notable underperformers included PLTR (-8%), SPOT (-2%), SHOP (-3.5%), and UBER (-7%), each struggling despite across-the-board beats, as they had rallied 40-150% YTD prior to their prints. Bitcoin experienced its worst day in six months, now at $100k, while retail factor/theme baskets (e.g., quantum computing, nuclear) and big tech/momentum stocks also weakened. Cruise lines were hit hard, with NCLH dropping 15% after reporting results and reducing its net yield guidance, following RCL’s miss last week.

Activity levels on the floor were subdued, scoring a 4 out of 10. The floor ended -81bps for sale versus a 30-day average of -91bps. Flow skews remained benign, with LOs finishing as slight net sellers and HFs roughly flat. Institutional activity in single stocks was notably quiet, while ETFs accounted for 30% of overall market volumes, with low sector dispersion pointing to significant top-down movement.

AFTER HOURS: AMD fell 2.5% despite a solid top-line beat, positive guidance, and an upcoming analyst day (11/11). ANET dropped 11% despite a strong quarterly beat. PINS plunged 15% due to decelerating revenue growth and a weaker midpoint for Q4 guidance. LITE gained 8.5% after issuing strong FQ2 net revenue guidance, despite falling 6.5% earlier in the day.

DERIVATIVES: Markets were relatively controlled. Yesterday’s straddle compressed to 42bps heading into the close, but overnight realized volatility exceeded that to the downside. Even as markets hit lows, volatility remained tame, with early morning levels slightly higher before compressing. Dealer long gamma played a role in stabilizing the dip, leading to an orderly session overall. January SPX volatility declined, as did the entire NDX term structure in volatility terms.

We maintain a preference for trades anticipating lower implied volatility, particularly in the short-dated space and within NDX. Current conditions present a high hurdle for volatility to perform on any rally from here. December ATM NDX volatility now exceeds 20

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!