SP500 LDN TRADING UPDATE 5/2/26

SP500 LDN TRADING UPDATE 5/2/26

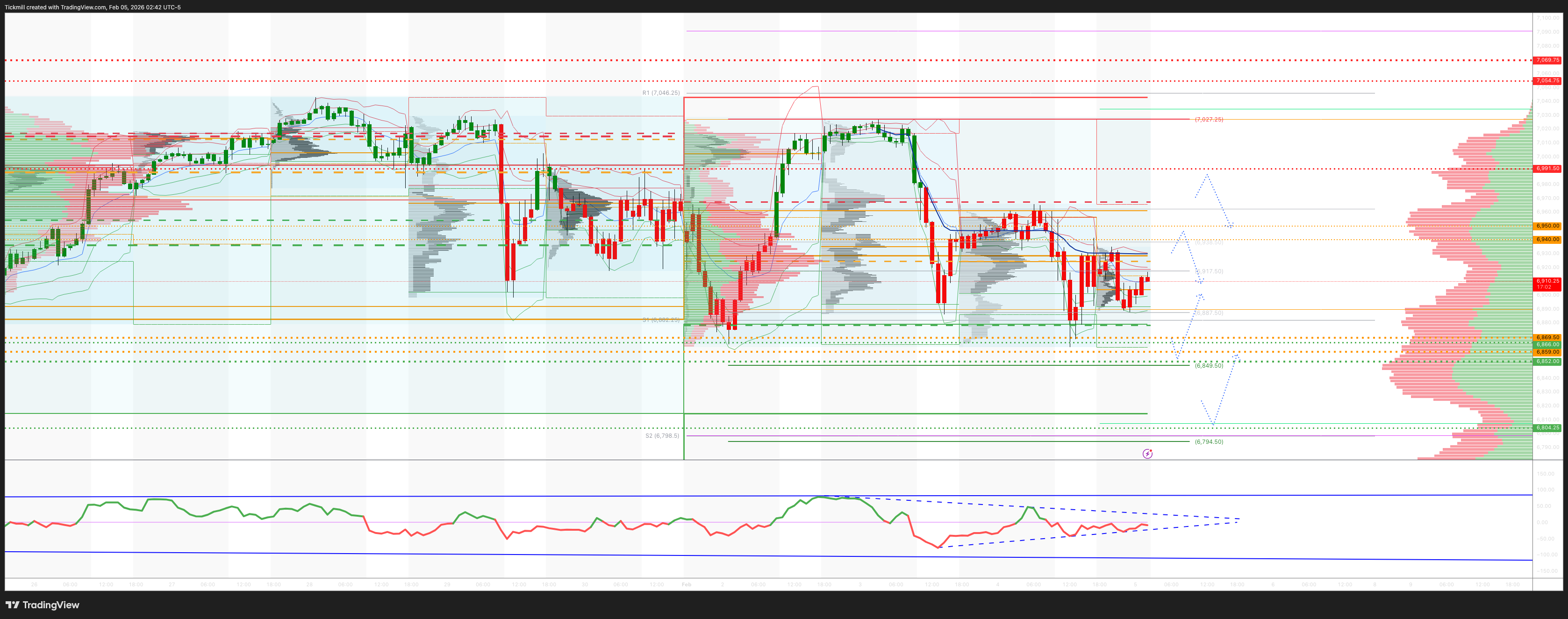

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6859/69

WEEKLY RANGE RES 7058 SUP 6869

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6962

DAILY VWAP BEARISH 6950

WEEKLY VWAP BULLISH 6962

MONTHLY VWAP BULLISH 6896

DAILY STRUCTURE – ONE TIME FRAMING LOWER - 6960

WEEKLY STRUCTURE – BALANCE - 7031/6822

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6822

DAILY BULL BEAR ZONE 6940/55

DAILY RANGE RES 6990 SUP 6866

2 SIGMA RES 7054 SUP 6804

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.20 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

SHORT ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 6900

LONG ON REJECT/RECLAIM OF WEEKLY/DAILY RANGE SUP TARGET 6900

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Momentum Drawdown”

S&P closed down -84bps at 6,918 with a MOC of $2.3bn to BUY. NDX dropped -155bps to 25,339, while R2K gained +31bps at 2,648, and the Dow slipped -34bps to 49,241. A total of 23.56b shares were traded across all US equity exchanges, compared to the YTD daily average of 19.12b shares. VIX increased +10.28% to 18.02, WTI Crude surged +311bps to $64.07, US 10YR yield dipped -1bp to 4.27%, gold soared +635bps to 4,958, DXY fell -28bps to 97.36, and Bitcoin declined -226bps to $76,685.

Momentum experienced a sharp drawdown on explosive volumes, with S&P E-Mini tracking +43%. Momentum traded down -10%, marking its largest daily drop in years, surpassing the Deepseek selloff last January. Geopolitical tensions added pressure, with US-Iran talks reportedly back on for Friday. As Callahan noted, while no specific catalyst emerged (EPS reactions from CDW & CTSH were higher, while AMD & FLEX were lower), Momentum entered the day in a demanding position, driven by breakout trades in leaders over laggards YTD. Elevated narrative volatility (higher VIX, AI volatility, commodities fluctuations, and crypto pullbacks) contributed to tail compression. Despite volatile moves, breadth remained healthy, with 75% of the index in the green and 16% hitting new 52-week highs. S&P Equal Weight outperformed by ~1.5%.

Momentum remains extremely crowded (99th percentile over 1 year, 100th percentile over 5 years), and a larger unwind of winners could lead to significant pain compared to a rotation, given positioning in our Prime Book (89th percentile over the last year). Historically, high sigma days for Momentum (e.g., Deepseek Monday, Covid) have led to fundamental narrative shifts. Our team believes panic or capitulation has not yet occurred, and given the strong run for the factor and elevated positioning, short-term hedging remains advisable. (Refer to Baskets Team note for further insights.)

Activity levels were intense, rated 8 on a 1-10 scale. The floor closed -392bps for sale versus a 30-day average of -55bps. Both LOs and HFs were ~$1.5b net sellers. Elevated activity persisted, with overlapping supply across healthcare, tech, memory, and discretionary sectors. Defensive positioning was observed in software and alternatives during the session.

POST BELL: GOOG rebounded +1% (was -7%) on strong Search and Cloud performance, both showing acceleration. However, CY26 CapEx guidance of $175-185bn has created mixed market sentiment, balancing AI-driven revenue growth in search/cloud against higher spending. AVGO jumped +5%, benefiting from Google's higher-than-expected Cloud growth and CapEx guidance. As the primary designer/manufacturer for Google’s custom AI TPUs, AVGO stands to gain from increased spending. AVGO's oversold position (-7% WTD) also contributed to the favorable setup. QCOM fell -9% after guiding F2Q revenues below consensus at ~$10.2-11.0bn versus $11.18bn expected.

DERIVATIVES: Despite the S&P closing down only -50bps, today’s market action resembled "adult swim." The short-term S&P CTA trigger has been breached, potentially unlocking systematic cohort supply if sustained. Volatility was notably bid in the front end for both S&P and Nasdaq. SPX skew was bid across the curve, while NDX skew showed limited reaction despite price action and tech earnings. NDX flows were mixed, with large hedging in front-end QQQ and vol RV selling in back-end NDX as spreads widened. The desk favors NDX put spreads or ratios in March and front-end downside protection in SPX. Dealer gamma positioning is expected to flip short on further selloffs, potentially amplifying market moves. The straddle through the end of the week priced at 130bps.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!