Weak China Data Weighs on Copper

Copper Capped for Now

Copper prices remain pressured at the start of the week following weak data from China overnight. The latest factory sector data showed that the sector grew below forecasts last month, adding to a slew of weak data recently. The RatingDog PMI fell to 50.6 from 50.9 previously, marking a six-month low in the S&P compiled data. The reading comes on the back of Friday’s official PMI which was seen falling for a seventh consecutive month, plunging to 49 from 49.8. The data is a worrying omen for copper demand and comes amidst signs of a drop in purchases. The Yangshan copper premium, which signals demand for copper imports was seen dropping to $36 last week from around $50 a month prior.

US/China Trade Deal

The weakness in Chinese data looks to be overshadowing the positive impact of the US/China trade deal announced last week. Trump and Xi agreed on a set of measures including a 12-month extension of the current tariff pause which was due to expire on Nov 10th. While there is optimism that relations between the two countries can improve from here, we’ve seen a somewhat muted market reaction from risk assets with focus instead on the surprise shift from the Fed last week.

Fed Uncertainty

While the US central bank cut rates by a further .25% last week, Powell warned that a follow-up cut in December is not a done deal given growing uncertainty amidst the absence of US data which is creating division among policymakers. Against this backdrop, USD continues to rally, creating further headwinds for copper and commodities generally.

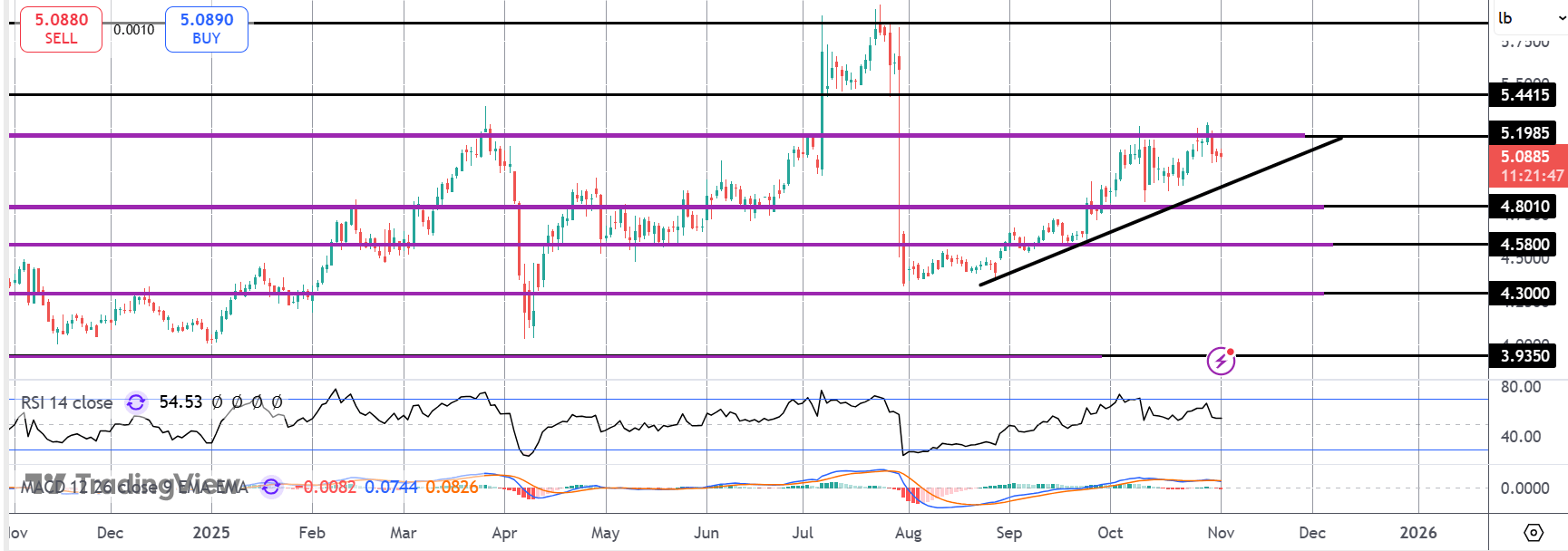

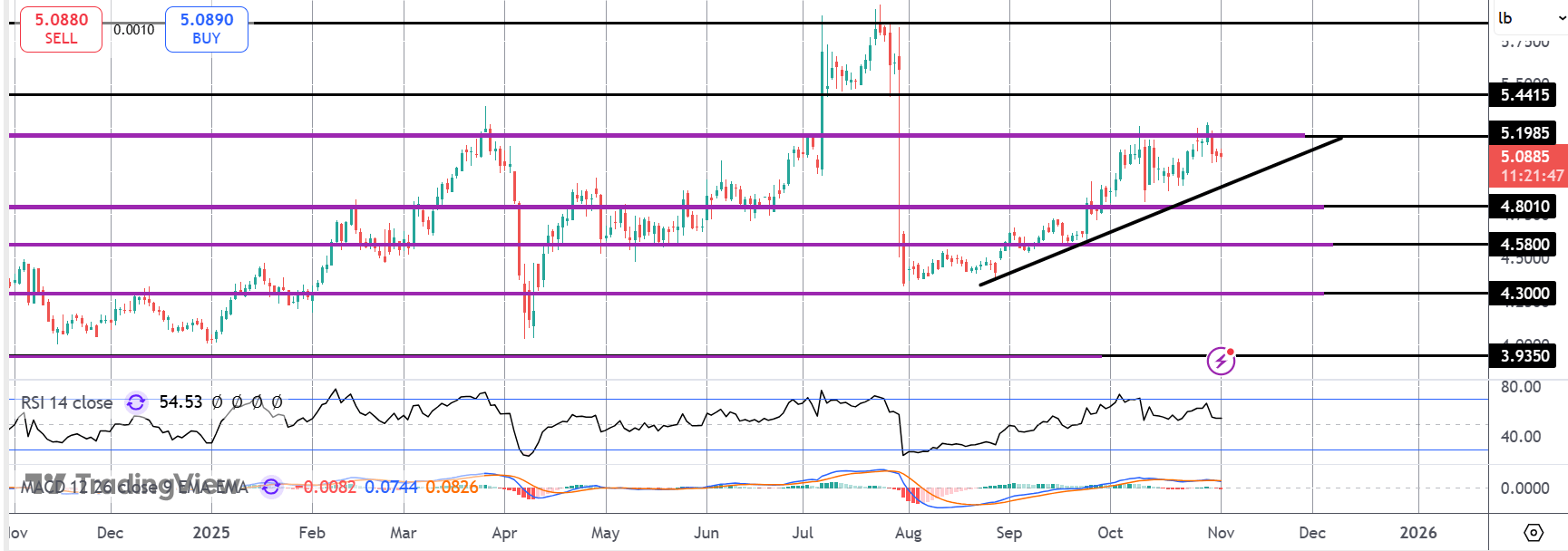

Technical Views

Copper

The rally in copper has stalled for now following a further failure at the 5.1985 level. With strong bearish divergence on momentum studies, the risk of a double top is seen here. The bull trend line off summer lows will be first support to watch ahead of the s4.8010 structural level which is the key near-term pivot.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.